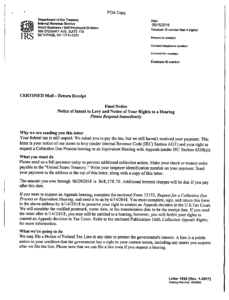

IRS Letter 1058 or LT11 – Final Notice of Intent to Levy

Letters 1058 and LT11 are sent as written notification, required by law, to inform you that the IRS intends to seize, or levy, your property, or rights to property. You have a right to a hearing.

Type of Notice: Unpaid balance

Likely next step: Address an IRS bill for unpaid taxes

Also see: IRS penalties

Why you received IRS Letter 1058 or LT11

- You filed a tax return with a balance due that was not paid by the due date.

- The IRS sent multiple notices requesting payment from you, but never received payment.

- The IRS sends Letter 1058 or LT11 to notify you of your right to a hearing on the matter and as your final notice of intent to levy your property, potentially including your paychecks, bank accounts, state income tax refunds and more.

Notice deadline: 30 days

If you miss the deadline: The IRS may file a Notice of Federal Tax Lien and/or issue a levy against wages, bank accounts or other assets if you don’t pay the balance or contact the IRS to establish a payment arrangement within 30 days.

Want more help?

Your tax professional can deal with the IRS for you. Learn more about H&R Block’s Tax Audit & Notice Services. Or make an appointment for a free consultation with a local tax professional by calling 855-536-6504 or finding a local tax pro.

Was this topic helpful?