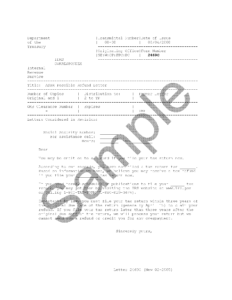

IRS Letter 2469C – Possible Refund Letter

You may have a refund due for a year in which no tax return was filed.

Type of Notice: Late return

Likely next step: File a tax return

Also see: IRS penalties, IRS bill for unpaid taxes

Why you received IRS Letter 2469C

- The IRS did not receive a tax return for the year in question.

- The IRS determined, based on information reported by others (employers, banks etc.), that you appear to have paid more in withholdings than would be required for the income reported.

- Letter 2469C was sent to notify you that you may be due a refund, provided a return is filed within three years of the original return due date.

Notice deadline: Three years from the return due date

If you miss the deadline: If you do not file a return within three years of the original return due date, you will not receive a refund for that tax year.

Want more help?

See your local tax pro for a free consultation.

Was this topic helpful?

Related tax terms

Related IRS notices

IRS Notice CP81 – Tax Return Not Received – Credit on Account