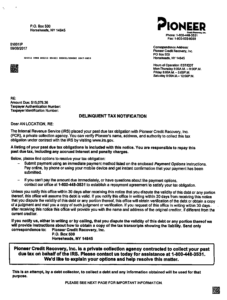

IRS Letter PCA – Private Collection Agency Notification

Your unpaid IRS tax balance has been transferred to a private debt collection agency.

Type of Notice: Unpaid balance

Likely next step: Address an IRS bill for unpaid taxes

Also see: IRS penalties

Why you received IRS Letter PCA

-

- You have an unpaid balance due that the IRS sent to a private debt collector.

- The IRS sent you a notice telling you which private debt collector your account has been assigned to.

- A private debt collector sent you this notice to inform you that they have your case and to provide you with information on how to pay your past-due taxes. This notice provides you with an authentication number so you can verify that the call/letter from the private collection agency is legitimate and so they can authenticate that they are speaking to the correct individual.

Notice deadline: N/A

Want more help?

Your tax professional can deal with the IRS for you. Learn more about H&R Block’s Tax Audit & Notice Services. Or make an appointment for a free consultation with a local tax professional by calling 855-536-6504 or finding a local tax pro.

Was this topic helpful?