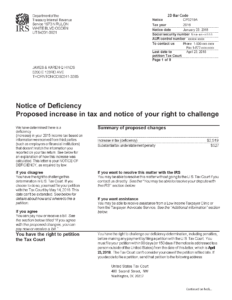

IRS Notice CP3219A – Notice of Deficiency & Increase in Tax

The IRS changed the amount of income tax on your return for the tax year shown on the notice.

Type of notice: Return accuracy

Likely next step: Address a CP2000 underreporter inquiry

Also see: IRS bill from unpaid taxes, IRS penalties

Why you received IRS Notice CP3219A

- After the IRS processed your return, additional information was reported to the IRS by third parties, such as your employer, bank, mortgage holder or other financial institution.

- The IRS sent you one or more notices requesting that you verify the income, credits or deductions on your tax return, but the IRS never received a response.

- The IRS is notifying you of your tax deficiency and explaining your right to file a petition in Tax Court.

Notice deadline: 90 days

If you miss the deadline: If you do not file a petition with the U.S. Tax Court by the date shown on the notice, you lose your right to challenge the additional assessment of tax. If no petition is filed with the court by the deadline, the IRS will assess tax, penalties and interest and send you a bill for the balance due.

Want more help?

Your tax professional can deal with the IRS for you. Learn more about H&R Block’s Tax Audit & Notice Services. Or make an appointment for a free consultation with a local tax professional by calling 855-536-6504 or finding a local tax pro.

Was this topic helpful?