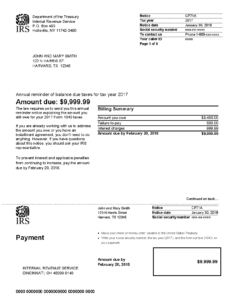

IRS Notice CP71A – Annual Balance Due Reminder Notice

CP71A is an annual statement of the total unpaid balance due for an account in currently not collectible status.

Type of Notice: Unpaid balance

Likely next step: Address an IRS bill for unpaid taxes

Also see: IRS penalties

Why you received IRS Notice CP71A

- You have an unpaid tax balance, but your account has been placed in currently not collectible status.

- The IRS is sending you a required annual statement of your balance due.

- Although a payment is not required currently, the notice gives a date you should pay by, if you want to keep additional penalties and interest from accumulating.

Notice deadline: N/A

Want more help?

Your tax professional can deal with the IRS for you. Learn more about H&R Block’s Tax Audit & Notice Services. Or make an appointment for a free consultation with a local tax professional by calling 855-536-6504 or finding a local tax pro.

Was this topic helpful?