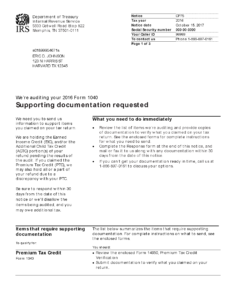

IRS Notice CP75 – Exam Initial Contact Letter – EIC Entire Refund Frozen

The IRS is auditing your tax return and holding the Earned Income Credit (EIC) portion of your refund.

Type of Notice: Return accuracy

Likely next step: Address an IRS audit

Also see: IRS penalties, IRS bill for unpaid taxes

Why you received IRS Notice CP75

- You claimed the Earned Income Tax Credit on your tax return.

- The IRS is questioning whether you are eligible to take the Earned Income Tax Credit.

- The IRS decided to audit your return and is requesting proof of items claimed on your tax return.

Notice deadline: 30 days

If you miss the deadline: The IRS will deny the Earned Income Tax Credit and you will have a reduced refund or a balance due.

Want more help?

Your tax professional can deal with the IRS for you. Learn more about H&R Block’s Tax Audit & Notice Services. Or make an appointment for a free consultation with a local tax professional by calling 855-536-6504 or finding a local tax pro.

Was this topic helpful?