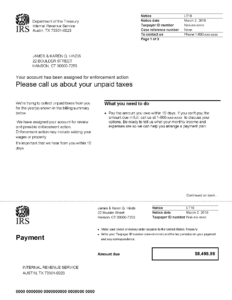

IRS Notice LT16 – Your Account Has Been Marked for Enforcement Action

You have overdue taxes and/or an overdue tax return.

Type of Notice: Unpaid balance, Late return

Likely next step: Address an IRS bill for unpaid taxes

Also see: Unfiled tax returns, IRS penalties

Why you received IRS Notice LT16

- You did not file a tax return and/or pay a balance due by the due date.

- The IRS sent multiple notices requesting that you file a return and/or make a payment but never received a response.

- The IRS sends LT16 to notify you that your account has been assigned to the office listed on the notice for enforcement action such as seizing part of your paychecks, bank accounts, state income tax refunds and more.

Notice deadline: 10 days

If you miss the deadline: The IRS may issue a levy against wages, bank accounts or other assets if you contact the IRS to resolve your account within 10 days.

Want more help?

See your local tax pro for a free consultation.

Was this topic helpful?