Qualifying Child

IRS Definition for EITC

Your child must have a Social Security number that is valid for employment that is issued before the due date of the tax return (including extensions) and must pass all the following tests to be your qualifying child for EITC:

Relationship

- Your son, daughter, adopted child, stepchild, foster child or a descendent of any of them such as your grandchild

- Brother, sister, half-brother, half-sister, step brother, step sister or a descendant of any of them such as a niece or nephew

Age

- At the end of the filing year, your child was younger than you (or your spouse if you file a joint return) and younger than 19

- At the end of the filing year, your child was younger than you (or your spouse if you file a joint return) younger than 24 and a full-time student

- At the end of the filing year, your child was any age and permanently and totally disabled

Residency

- Child must live with you (or your spouse if you file a joint return) in the United States for more than half of the year

Joint Return

- The child cannot file a joint return for the tax year unless the child and the child’s spouse did not have a separate filing requirement and filed the joint return only to claim a refund.

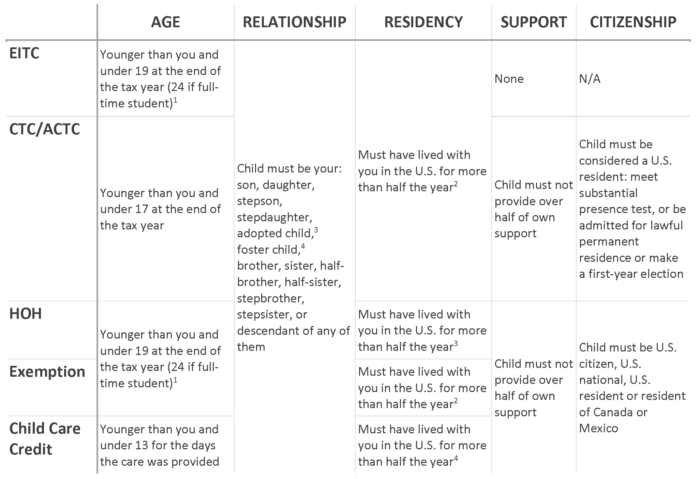

IRS Definition for exemptions, child tax and additional child tax credit, head of household filing status and the child and dependent care credit

Five tests must be met for a child to be your qualifying child. The five tests are:

- Relationship,

- Age,

- Residency,

- Support, and

- Joint return.

More from H&R Block

The rules for determining if a child is your qualifying child depends on how you are going to use that classification. The rules for a qualifying child for the Earned Income Tax Credit (EITC) differ from the rules to determine a qualifying child for exemptions, to determine head of household (HOH) status, for the Child Tax Credit or Additional Child Tax Credit (CTC/ACTC) or for the child/dependent care credit.

One key difference for the EITC is that the child must have a valid Social Security Number that was issued by the due date of the return (including extensions). Children with an individual taxpayer identification number (ITIN) or an adoption taxpayer identification number (ATIN) are not qualifying children for the EITC. An ITIN or ATIN are allowed in qualifying for the other credits and exemptions.

The rule for divorced or separated parents applies for the exemption and the child tax credit. The rule does not apply for the other credits.

1 Any age if totally and permanently disabled.

2Except for: temporary absence, birth or death of child, kidnapped child, divorced or separated parent who live apart

3Except for: temporary absence, birth or death of child, kidnapped child

4Except for: temporary absence, birth or death of child

Learn how to address a return or account problem related to qualifying child. Or, learn how to handle an IRS audit.

Was this topic helpful?