H&R Block Reports Market Share Gains in First Half of Tax Season; Announces Fiscal 2017 Third Quarter Results

H&R Block, Inc. (NYSE: HRB) today released U.S. tax return volume through February 28 and its financial results for the fiscal 2017 third quarter ended January 31, 2017. The company typically reports a fiscal third quarter operating loss due to the seasonality of its tax business.

Fiscal Third Quarter and Tax Season Highlights1

- H&R Block Assisted and do-it-yourself (DIY) tax preparation businesses achieve market share gains in the first half of the tax season.

- Revenues and earnings for the fiscal 2017 third quarter impacted by delayed tax season; company reiterates financial outlook for full year.

- Revenues declined $23 million due to the delayed tax season, while total operating expenses declined $18 million primarily due to cost reduction efforts, which led to lower compensation and benefits and marketing costs.

- Loss per share increased $0.15 due entirely to reductions in the company’s effective tax rate and shares outstanding. The reduction in shares outstanding will be accretive on a full year basis, but negatively impacts those quarters with a seasonal net loss.

- Repurchased approximately 4.4 million shares for an aggregate purchase price of $100 million during the third quarter, bringing total share repurchases for fiscal 2017 to approximately 14.0 million shares for $317 million.

Tax Season Results2

H&R Block return volume outperformed industry results when compared to IRS data reported through February 24. In total, the IRS reported a decline in e-files of 10% compared to the company’s decline of 7%. Market share gains were realized in both the Assisted and DIY categories. In the Assisted category, H&R Block outperformed the industry with a decline of 8% compared to the IRS reported decline of 13%. In the DIY category, H&R Block outperformed the industry with a decline of 5% compared to the IRS reported decline of 8%. While overall industry and company volume is expected to improve during the second half of the tax season, company performance relative to the industry is expected to moderate given the conclusion of its Free Federal 1040EZ and Refund Advance promotions on February 28.

CEO Perspective

“We are delivering what we promised in December. Through aggressive Assisted and DIY offers, we are achieving our goal of new client growth and I’m pleased that we gained market share in both the Assisted and DIY tax preparation categories in the first half of the tax season,” said Bill Cobb, H&R Block’s president and chief executive officer. “I’m proud of what we have accomplished so far. These results are in line with our expectations for the first half of the season. And with our new partner, IBM Watson, we are focused on continued execution of our reinvented client experience over the remainder of the tax season.”

The growth in market share is attributable to solid execution of an aggressive plan designed to change the trajectory of prior year client losses. In the Assisted tax preparation business, this included the launch of the no-interest, no-fee Refund Advance loan product and the Free Federal 1040EZ promotion. The company also introduced a new, exclusive client experience that incorporates IBM Watson, bringing the power of cognitive computing technology and the expertise of over 60 years of tax preparation experience together for the first time in the industry. In the company’s DIY business, it expanded its free filing option with the launch of H&R Block More ZeroSM and introduced significant product enhancements.

For the fiscal year, H&R Block expects to deliver results in line with its annual financial outlook previously provided in December 2016.

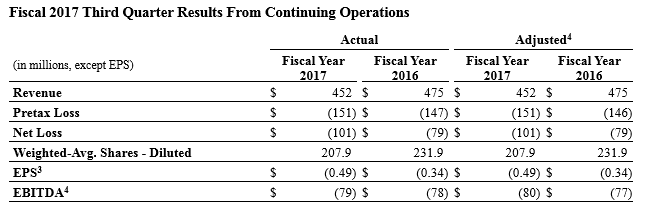

Income Statement

- Total revenues decreased $22.7 million to $451.9 million, primarily due to lower client volumes in the Assisted and DIY tax preparation businesses resulting from the delay in the overall tax season, coupled with the pricing impact of the early season promotions such as Free Federal 1040EZ and H&R Block More Zero.

- Total operating expenses decreased $17.7 million to $576.7 million. Compensation and benefits and marketing expenses declined as a result of prior year cost reduction efforts. The reductions were partially offset by third-party fees associated with the Refund Advance product.

- Pretax loss increased $4.1 million to $150.6 million.

- Loss per share from continuing operations increased $0.15 to $0.49, due entirely to reductions in the company’s effective tax rate and shares outstanding. The reduction in shares outstanding will be accretive on a full year basis, but negatively impacts those quarters with a seasonal net loss.

CFO Perspective

“We are starting to fully realize the benefits of last year’s cost reduction efforts,” said Tony Bowen, H&R Block’s chief financial officer. “These savings have enabled us to invest in other areas of the business, including our early season promotions and our new DIY pricing structure, which have been instrumental in achieving new client growth and taking market share in the first half of this season.”

Balance Sheet

- Mortgage loans and real estate owned were liquidated during the third fiscal quarter for cash proceeds of $188.2 million, which approximated book value.

- Seasonal line of credit borrowings, which are included in long-term debt, were $1.1 billion as of January 31, 2017.

Discontinued Operations

- Sand Canyon Corporation’s accrual for contingent losses related to representation and warranty claims decreased $21 million from the prior quarter to $5 million as a result of settlement payments to counterparties. The settlement payments were fully covered by prior accruals.

Share Repurchases and Dividends

- During the third quarter of fiscal 2017, the company repurchased and retired approximately 4.4 million shares at an aggregate price of $100.0 million, or $22.83 per share bringing the total share repurchases for fiscal 2017 to approximately 14.0 million shares for $317.0 million. As of January 31, 2017, 207.2 million shares were outstanding.

- The company completed these share repurchases under a $3.5 billion share repurchase program approved by the company’s board of directors in August 2015, which runs through June 2019. Under this program, the company has repurchased approximately 70 million shares of its common stock, or 25.5% of shares outstanding at the beginning of the program, for an aggregate purchase price of approximately $2.3 billion.

- As previously announced, a quarterly cash dividend of $0.22 per share is payable on April 3, 2017 to shareholders of record as of March 14, 2017. H&R Block has paid quarterly dividends consecutively since the company went public in 1962.

Conference Call

Discussion of the fiscal 2017 third quarter results, future outlook and a general business update will occur during the company’s previously announced fiscal third quarter earnings conference call for analysts, institutional investors, and shareholders. The call is scheduled for 4:30 p.m. Eastern time on March 7, 2017. To access the call, please dial the number below approximately 10 minutes prior to the scheduled starting time:

U.S./Canada (888) 895-5260 or International (443) 842-7595

Conference ID: 46102763

The call will also be webcast in a listen-only format for the media and public. The link to the webcast can be accessed directly at http://investors.hrblock.com.

A replay of the call will be available beginning at 7:30 p.m. Eastern time on March 7, 2017, and continuing until April 7, 2017, by dialing (855) 859-2056 (U.S./Canada) or (404) 537-3406 (International). The conference ID is 46102763. The webcast will be available for replay March 8, 2017 at http://investors.hrblock.com.

About H&R Block

H&R Block, Inc. (NYSE: HRB) is a global consumer tax services provider. Tax return preparation services are provided by professional tax preparers in approximately 12,000 company-owned and franchise retail tax offices worldwide, and through H&R Block tax software products for the DIY consumer. H&R Block also offers adjacent Tax Plus products and services. In fiscal 2016, H&R Block had annual revenues of over $3 billion with 23.2 million tax returns prepared worldwide. For more information, visit the H&R Block Newsroom.

About Non-GAAP Financial Information

This press release and the accompanying tables include non-GAAP financial information. For a description of these non-GAAP financial measures, including the reasons management uses each measure, and reconciliations of these non-GAAP financial measures to the most directly comparable financial measures prepared in accordance with generally accepted accounting principles, please see the section of the accompanying tables titled “Non-GAAP Financial Information.”

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the securities laws. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words or variation of words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “projects,” “forecasts,” “targets,” “would,” “will,” “should,” “goal,” “could” or “may” or other similar expressions. Forward-looking statements provide management’s current expectations or predictions of future conditions, events or results. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future are forward-looking statements. They may include estimates of revenues, income, earnings per share, cost savings, capital expenditures, dividends, share repurchases, liquidity, capital structure or other financial items, descriptions of management’s plans or objectives for future operations, products or services, or descriptions of assumptions underlying any of the above. All forward-looking statements speak only as of the date they are made and reflect the company’s good faith beliefs, assumptions and expectations, but they are not guarantees of future performance or events. Furthermore, the company disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions, factors, or expectations, new information, data or methods, future events or other changes, except as required by law. By their nature, forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. Factors that might cause such differences include, but are not limited to, a variety of economic, competitive and regulatory factors, many of which are beyond the company’s control, that are described in our Annual Report on Form 10-K for the fiscal year ended April 30, 2016 in the section entitled “Risk Factors” and additional factors we may describe from time to time in other filings with the Securities and Exchange Commission. You may get such filings for free at our website at http://investors.hrblock.com. You should understand that it is not possible to predict or identify all such factors and, consequently, you should not consider any such list to be a complete set of all potential risks or uncertainties.

1 All amounts in this release are unaudited. Unless otherwise noted, all comparisons refer to the current period compared to the corresponding prior year period.

2 Volume changes to prior year noted in this paragraph are based on accepted e-files on a day-to-day basis, which is consistent with IRS reported results. Volume changes noted in the table attached to this release are based on a date-to-date basis.

3All per share amounts are based on fully diluted shares at the end of the corresponding period.

4 The company reports non-GAAP financial measures, including earnings before interest, tax, depreciation, and amortization (EBITDA) and adjusted financial performance, which it believes are a better indication of the company’s core operations. See “About Non-GAAP Financial Information” below for more information regarding financial measures not prepared in accordance with generally accepted accounting principles (GAAP).