H&R Block Reports Fiscal 2022 First Quarter Results; Reiterates Fiscal Year Financial Outlook

KANSAS CITY, Mo. – H&R Block, Inc. (NYSE: HRB) (the “Company”) today released its financial results1 for the fiscal 2022 first quarter ended September 30, 2021.

- Q1 results demonstrated continued momentum across the business and the Company reiterates its previously given fiscal year 2022 outlook.

- The year over year quarterly results are not comparable due to last year’s tax season being extended to July 15, 2020, causing revenue and earnings to occur in the prior year first quarter that did not repeat in the first quarter ending September 30, 2021, as this year’s tax season was extended only to May 17, 2021.

- The Company repurchased $166 million of shares, retiring approximately 4% of the shares outstanding during the fiscal quarter.

“Our first fiscal quarter reflects continued momentum in the businesses, our ongoing commitment to returning capital to shareholders, and progress on our Block Horizons imperatives,” said Jeff Jones, H&R Block’s president and CEO. “Looking forward, we are well positioned for the 2022 tax season and I am more confident than ever in our ability to execute against our next phase of strategic growth.”

Fiscal 2022 First Quarter Results Key Financial Metrics

“We have made significant financial progress over the past several years, and our business continues to be strong,” said Tony Bowen, H&R Block’s chief financial officer. “We’re off to a great start to our fiscal year and were able to repurchase $166 million of shares during the quarter.”

Year over year quarterly results are not comparable due to last year’s tax season being extended to July 15, 2020 causing revenue and earnings to occur in the prior year first quarter that did not repeat in the first quarter ending September 30, 2021, as this year’s tax season was extended only to May 17, 2021. Revenue recorded in last year’s fiscal Q1 related to the extended tax season is estimated to be $246 million.

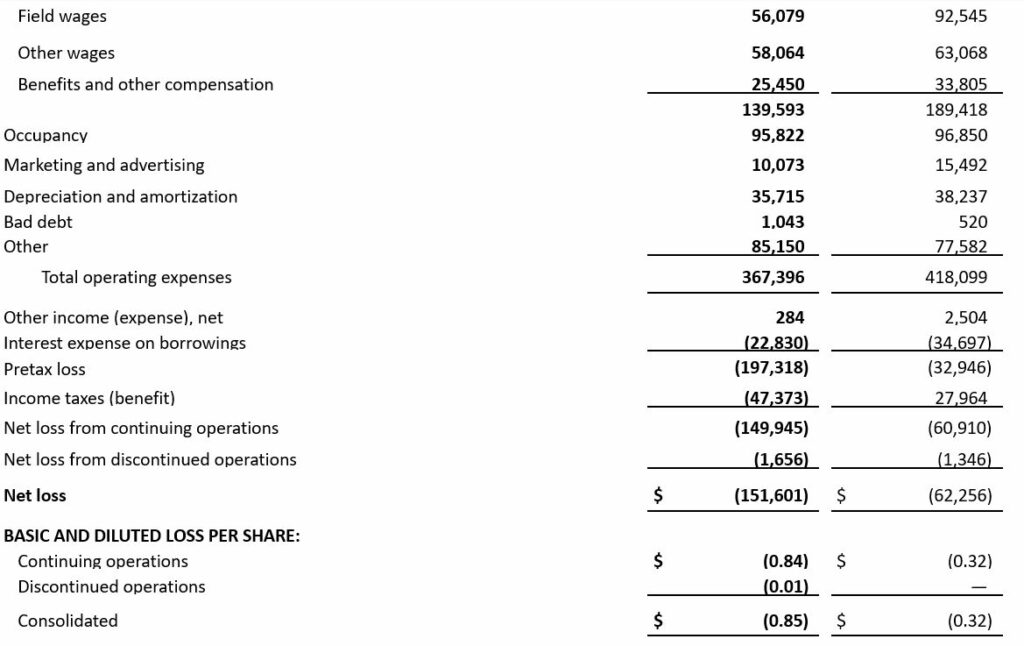

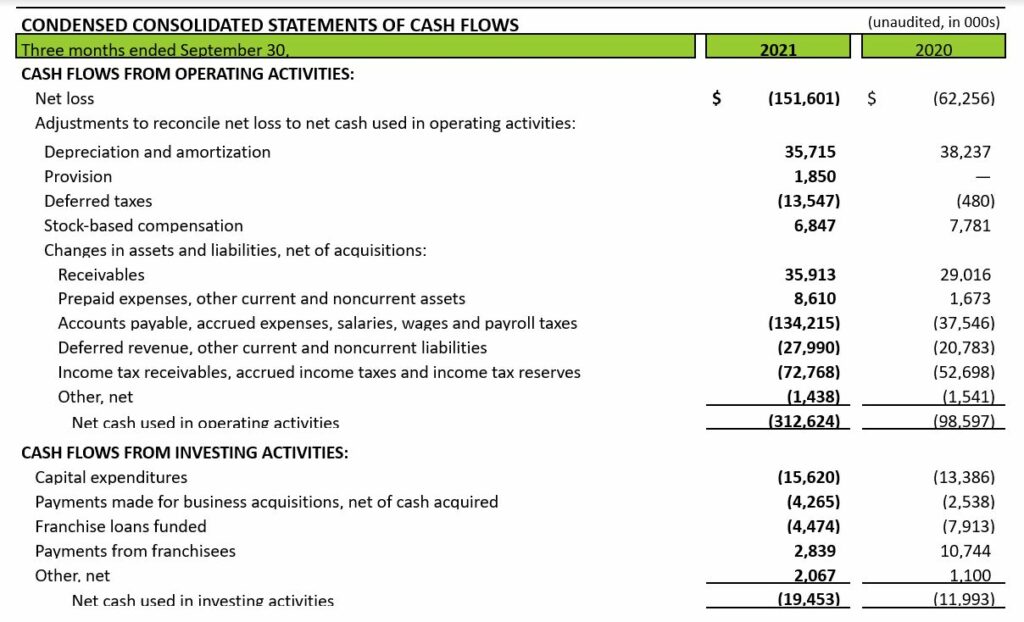

- Total revenue of $193 million decreased by $225 million, or 54%, to the prior year. The decrease in revenue is entirely due to lower return volume because of the previous year’s tax season extension. This was partially offset by Emerald Card revenue and strong growth from Wave.

- Total operating expenses of $367 million decreased by $51 million, or 12%, primarily driven by lower tax pro compensation on lighter return volumes as the quarter took place after the 2021 filing deadline.

- Pretax loss increased by $164 million to $197 million, entirely due to the decrease in revenue because of the previous year’s tax season extension.

- Loss per share from continuing operations2 increased from $0.32 to $0.84; adjusted loss per share from continuing operations increased from $0.24 to $0.78.

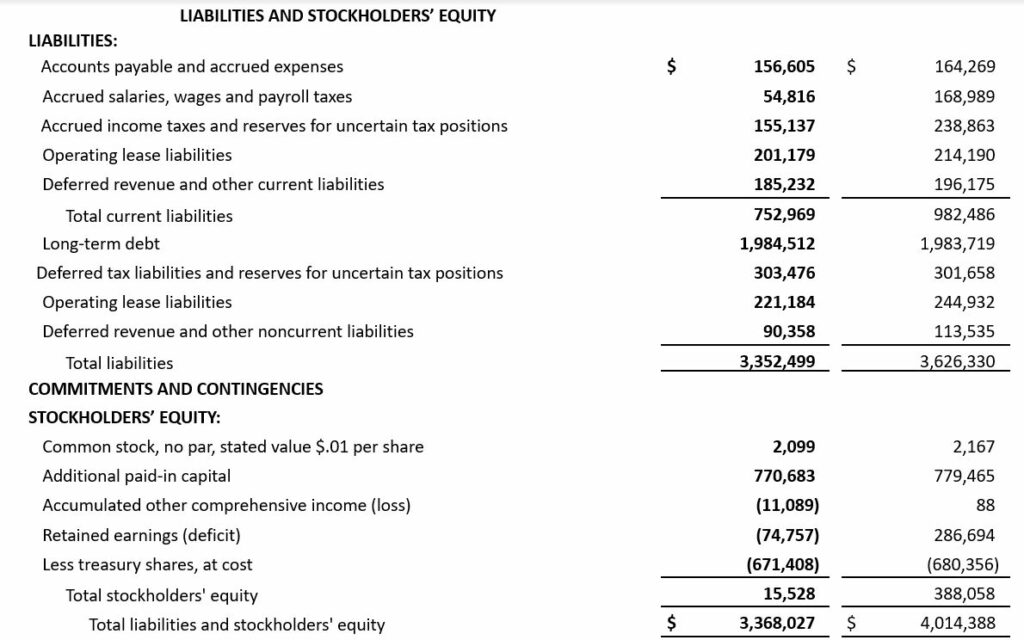

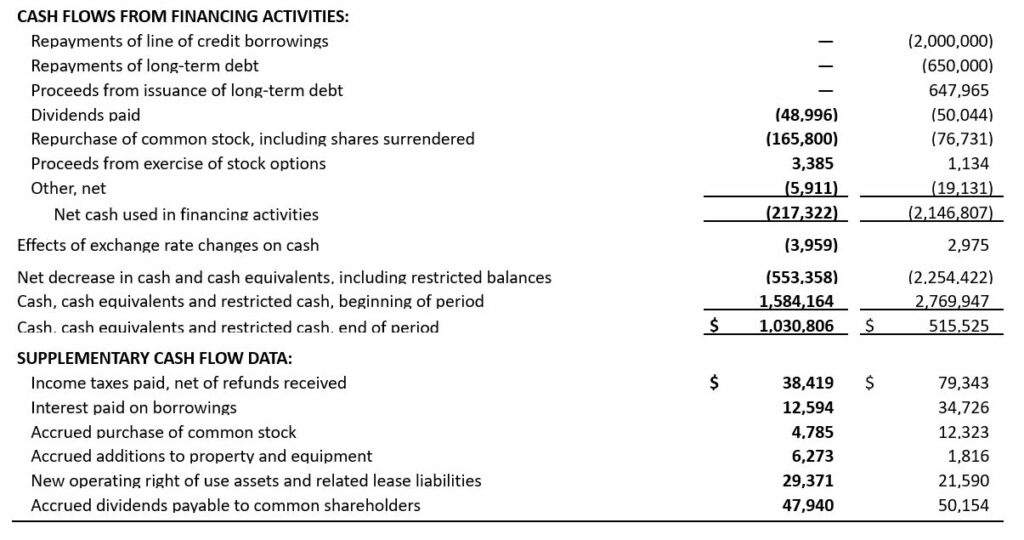

Capital Structure

The Company also reported the following related to its capital structure:

- Fiscal year first quarter repurchases and retirements of common stock totaled approximately 6.8 million shares at an aggregate price of $166 million, or $24.37 per share. The Company has approximately $400 million remaining on its authorization which runs through June 2022.

- As previously announced, a quarterly cash dividend of $0.27 per share was paid on October 1, 2021 to shareholders of record as of September 10, 2021. H&R Block has paid quarterly dividends consecutively since the Company became public in 1962.

Discontinued Operations

For information on Sand Canyon, please refer to disclosures in the Company’s reports on Forms 10-K, 10-Q, and other filings with the SEC.

Conference Call

Discussion of the fiscal 2022 first quarter results, outlook, and a general business update will occur during the Company’s previously announced fiscal first quarter earnings conference call for analysts, institutional investors, and shareholders. The call is scheduled for 4:30 p.m. Eastern time on November 2, 2021. To access the call, please dial the number below approximately 5 minutes prior to the scheduled starting time:

U.S./Canada (866) 987-6821or International (630) 652-5951

Conference ID: 5163538

The call, along with a presentation for viewing, will also be webcast in a listen-only format for the media and public. The webcast can be accessed directly https://investors.hrblock.com/financial-information/quarterly-results, and the presentation will be posted following the conclusion of the call.

A replay of the call will be available beginning at 7:30 p.m. Eastern time on November 2, 2021 and continuing for seven days by dialing (855) 859-2056 (U.S./Canada) or (404) 537-3406 (International). The conference ID is 5163538. The webcast will be available for replay beginning on November 3, 2021 and continuing for 90 days at https://investors.hrblock.com/financial-information/quarterly-results.

About H&R Block

H&R Block, Inc. (NYSE: HRB) provides help and inspires confidence in its clients and communities everywhere through global tax preparation, financial products, and small business solutions. The company blends digital innovation with the human expertise and care of its associates and franchisees as it helps people get the best outcome at tax time, and better manage and access their money year-round. Through Block Advisors and Wave, the company helps small business owners thrive with innovative products like Wave Money, a small business banking and bookkeeping solution, and the only business bank account to manage bookkeeping automatically. For more information, visit H&R Block News or follow @HRBlockNews on Twitter.

About Non-GAAP Financial Information

This press release and the accompanying tables include non-GAAP financial information. For a description of these non-GAAP financial measures, including the reasons management uses each measure, and reconciliations of these non-GAAP financial measures to the most directly comparable financial measures prepared in accordance with generally accepted accounting principles, please see the section of the accompanying tables titled “Non-GAAP Financial Information.”

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the securities laws. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words or variation of words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “commits,” “seeks,” “estimates,” “projects,” “forecasts,” “targets,” “would,” “will,” “should,” “goal,” “could” or “may” or other similar expressions. Forward-looking statements provide management’s current expectations or predictions of future conditions, events or results. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future are forward-looking statements. They may include estimates of revenues, client trajectory, income, effective tax rate, earnings per share, cost savings, capital expenditures, dividends, share repurchases, liquidity, capital structure, market share, industry volumes or other financial items, descriptions of management’s plans or objectives for future operations, products or services, or descriptions of assumptions underlying any of the above. They also include the expected impact of the coronavirus (COVID-19) pandemic, including, without limitation, the impact on economic and financial markets, the Company’s capital resources and financial condition, the expected use of proceeds under the Company’s revolving credit facility, future expenditures, potential regulatory actions, such as extensions of tax filing deadlines or other related relief, changes in consumer behaviors and modifications to the Company’s operations related thereto. All forward-looking statements speak only as of the date they are made and reflect the Company’s good faith beliefs, assumptions and expectations, but they are not guarantees of future performance or events. Furthermore, the Company disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions, factors, or expectations, new information, data or methods, future events or other changes, except as required by law. By their nature, forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. Factors that might cause such differences include, but are not limited to a variety of economic, competitive and regulatory factors, many of which are beyond the Company’s control, that are described in our Annual Report on Form 10-K for the fiscal year ended April 30, 2021 in the section entitled “Risk Factors” and additional factors we may describe from time to time in other filings with the Securities and Exchange Commission. You may get such filings for free at our website at https://investors.hrblock.com. In addition, factors that may cause the Company’s actual estimated effective tax rate to differ from estimates include the Company’s actual results from operations compared to current estimates, future discrete items, changes in interpretations and assumptions the Company has made, future actions of the Company, or increases in applicable tax rates in jurisdictions where the Company operates. You should understand that it is not possible to predict or identify all such factors and, consequently, you should not consider any such list to be a complete set of all potential risks or uncertainties.

TABLES FOLLOW

(1) All non-GAAP measures are results form continuing operations. See “Non-GAAP Financial Information” for a reconciliation of non-GAAP measures.

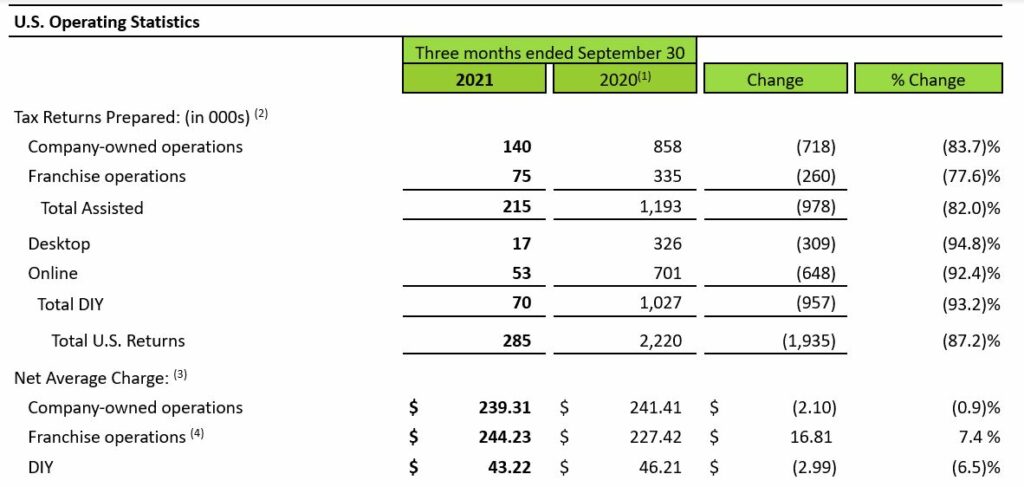

(1) Represents a partial 2019 individual tax filing season, which was extended until July 15, 2020.

(2) An assisted tax return is defined as a current or prior year individual or business tax return that has been accepted by the client. A DIY online return is defined as a current year individual or business tax return that has been accepted by the client. A DIY desktop return is defined as a current year individual or business tax return that has been electronically submitted to the IRS.

(3) Net average charge is calculated as total tax preparation fees divided by tax returns prepared.

(4) Net average charge related to H&R Block Franchise operations represents tax preparation fees collected by H&R Block franchisees divided by returns prepared in franchise offices. H&R Block will recognize a portion of franchise revenues as franchise royalties based on the terms of franchise agreements.

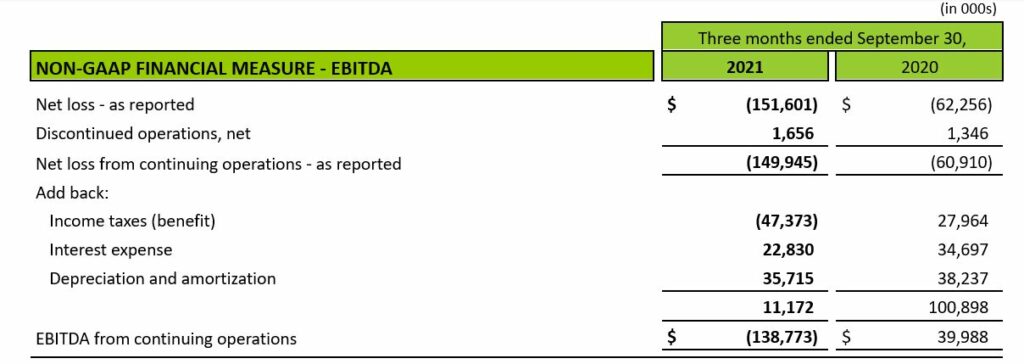

NON-GAAP FINANCIAL INFORMATION

Non-GAAP financial measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. Because these measures are not measures of financial performance under GAAP and are susceptible to varying calculations, they may not be comparable to similarly titled measures for other companies.

We consider our non-GAAP financial measures to be performance measures and a useful metric for management and investors to evaluate and compare the ongoing operating performance of our business. We make adjustments for certain non-GAAP financial measures related to amortization of intangibles from acquisitions and goodwill impairments. We may consider whether other significant items that arise in the future should be excluded from our non-GAAP financial measures.

We measure the performance of our business using a variety of metrics, including earnings before interest, taxes, depreciation and amortization (EBITDA) from continuing operations, adjusted EBITDA from continuing operations, EBITDA margin from continuing operations, adjusted diluted earnings per share from continuing operations and free cash flow. We also use EBITDA from continuing operations and pretax income of continuing operations, each subject to permitted adjustments, as performance metrics in incentive compensation calculations for our employees.